Situation

Currently, European nations have set varying legal standards for EPC’s. Although Germany, Portugal and Spain have no regulatory minimum, owners are legally required to possess an EPC certificate for each asset/unit. The Netherlands however requires all office buildings to achieve at least a ‘C’ from 2023, and ‘B’ from 2025, with administrative penalties for non-compliance, including fines of €10,000 per infringement and potential criminal prosecution.

In the UK, all rented commercial properties must achieve an ‘E’ or higher as of April 2023, and failing to meet this standard may result in fines of up to £30,000. Furthermore, all buildings must reach a rating of ‘C’ by 2025 and ‘B’ by 2030. A recent Savills report indicates that UK retail units have reached an EPC ‘cliff edge’, with over 185 million sqft now at risk of being unlettable following on from the introduction of the mandatory ‘E’ minimum set in 2023.

This regulation demands immediate attention from commercial real estate owners, as it has become paramount to prioritise improving energy efficiency ratings to align with the evolving EPC standards. By addressing the new EPC requirements promptly, owners can safeguard their investments, ensure long-term compliance with energy efficiency demands, and position themselves advantageously within the competitive marketplace. Failure to do so could result in significant financial risks, ranging from difficulties attracting prospective tenants (who may opt for more energy-efficient spaces), to problems attracting liquidity and securing refinancing.

Activity

Throughout 2023, Avignon continued to proactively review EPCs across its entire portfolio, and is continuously exploring opportunities to ensure that its assets are aligned with the relevant local government’s long-term minimum target ratings.

We worked alongside expert assessors to ensure that all of our assets are on a pathway to exceed current and future energy efficiency requirements. Our partnership with these assessors allowed us to identify opportunities for improvement, and we have gained valuable insights into enhancing the performance of our assets, reducing energy consumption, and ultimately delivering greater value to our investors.

Outcome

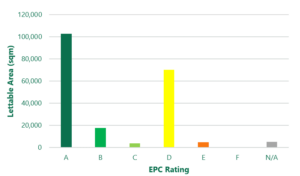

Avignon Capital is pleased to report that as of Q3 2023, 62% of our total assets under management (based on LFA) are rated EPC ‘B’ or higher, ensuring regulatory compliance well beyond 2030. Furthermore, 81.7% of our Dutch portfolio is rated ‘A’, with a further 7.5% rated ‘B’. Any asset currently possessing an EPC of C or lower is being proactively managed by our asset and property management teams, and robust asset management schedules have been formulated. Planned interventions include solar PV installations, high-efficiency HVAC systems, insulation upgrades, energy efficient lighting and beyond. We are targeting 100% EPC compliance with all local regulatory standards by across our portfolio by Q4 2024 to limit any obsolescence risk.